Section 179 Tax Deduction

Section 179 Allows You to Write Off Your Entire Duct Cleaning Equipment Purchase for the Current Tax Year

Now is a great time to get into the HVAC industry! You can purchase RamAir Duct Cleaning Equipment and vehicles for your new HVAC business before December 31 and write off the entire purchase for the current tax year.

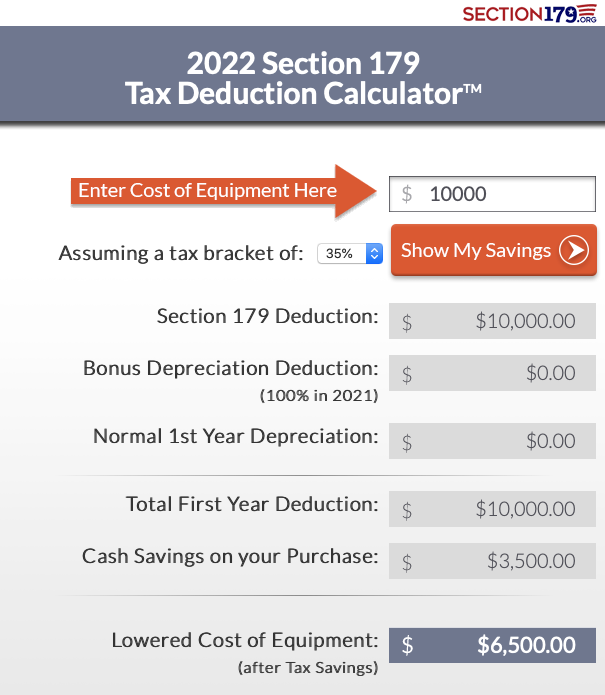

The section 179 tax deduction is an immediate expense deduction that business owners can take for business equipment purchases instead of capitalizing and depreciating the asset over time. Qualifying purchases include those related to depreciable assets such as equipment, vehicles, and software. All RamAir Duct Cleaning Equipment would be applicable to Section 179 tax relief.

The deduction can be taken for the full price regardless of if the piece of equipment is purchased or financed. The maximum deduction is $1,080,000 and property purchased to $2,700,000 for the year 2022.

Leasing and Equipment Financing

Non-tax capital leases and equipment finance agreements qualify for Section 179 depreciation. With a lease or equipment finance contract, businesses can acquire and write-off up to $1,080,000 worth of qualifying equipment during the 2022 tax year.

Qualifications

- Equipment purchases must be put to use by December 31, 2023.

- Businesses may purchase new or used equipment, and/or retail software, to qualify under Section 179.

Section 179 Deduction Basics for Duct Cleaning Equipment Purchases

- Businesses are entitled to deduct up to $1,080,000 of the cost of qualifying equipment acquisitions.

- The maximum cap on equipment purchases is $2,700,000 during the 2022 tax season. Once this amount is reached, businesses can take bonus depreciation – for new equipment only.

- Always check with your tax advisor for specific details related to your business.

Example Cleaning Equipment that Quality for Section 179

-

Platinum Air Duct Cleaning System & Decontamination Package

$4,995.00 -

Standard Air Duct Cleaning System & Decontamination Package

$2,395.00 -

Cyclonic PowerVac Portable Air Duct Vacuum System

$2,795.00 -

SaniJet Duct Sanitizing System

$895.00 -

Bio-Oxygen® Chem Decon

$235.97 – $359.99 -

Ozogen 16g High Output Ozone Generator

$2,495.00 -

OzoGen DC 3.4 Ozone Decontamination Chamber

$8,000.00